Capacity Markets Explained: Key Insights for the Future of Energy

In the evolving landscape of energy management, capacity markets play a crucial role in ensuring grid stability and reliability. While some countries, like Austria and the Czech Republic, lack fully established capacity market mechanisms, innovative cross-border collaborations are addressing these gaps. For example, Austria and the Czech Republic have partnered with Germany to create ALPACA, a shared platform for an aFRR (automatic Frequency Restoration Reserve) balancing capacity market. This initiative reduces procurement costs by pooling resources across borders, enhancing efficiency.

Similarly, the Nordic countries have introduced an aFRR capacity market mechanism. By procuring capacity ahead of the day-ahead market, this system facilitates cross-border capacity trading.

The European Resource Adequacy Assessment (ERAA) has underscored the growing need for mechanisms that guarantee energy reliability, especially as the share of renewable energy increases and generation becomes more variable. Capacity markets are becoming essential to ensuring system stability by compensating resources for being available during peak demand or supply disruptions.

What is Capacity Market?

A Capacity Market is a type of electricity market designed to ensure there is enough power available to meet demand, especially during times of high usage or emergencies. It works by paying electricity producers and storage providers to be on standby and ready to produce electricity when needed, even if they don’t generate it all the time.

In a capacity market, power companies or energy storage operators commit to providing a certain amount of electricity capacity at a future time. They are paid for this commitment, ensuring that there is always enough energy available to keep the grid stable and avoid shortages. The idea is to keep the system reliable, so even during peak demand periods, there’s enough power to go around.

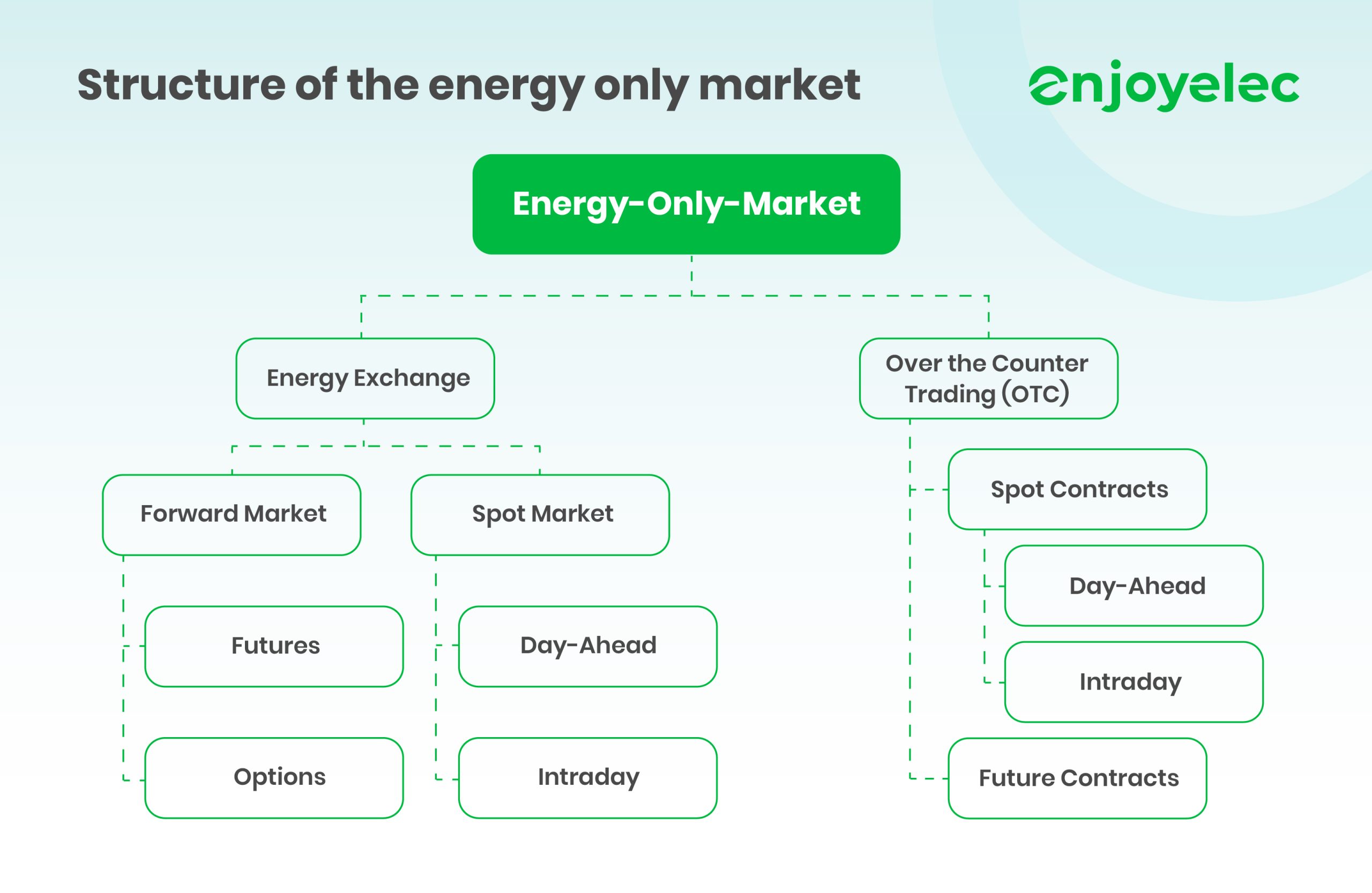

Energy-Only Market vs. Capacity Market

In contrast, the Capacity Market is designed to guarantee that there is enough available electricity generation capacity to meet future demand, particularly during peak periods or emergencies. Unlike the energy market, which compensates producers based on actual electricity consumption, the capacity market compensates power producers for being ready to generate power when required, even if they aren’t actively producing at that time.

In this context, capacity in the capacity market is not directly tied to the amount of electricity generated but rather to the ability of power plants to provide electricity when it is needed most. This means that while the energy market compensates power for its immediate delivery, the capacity market compensates for the availability to generate electricity, ensuring that enough resources are on standby for future needs.

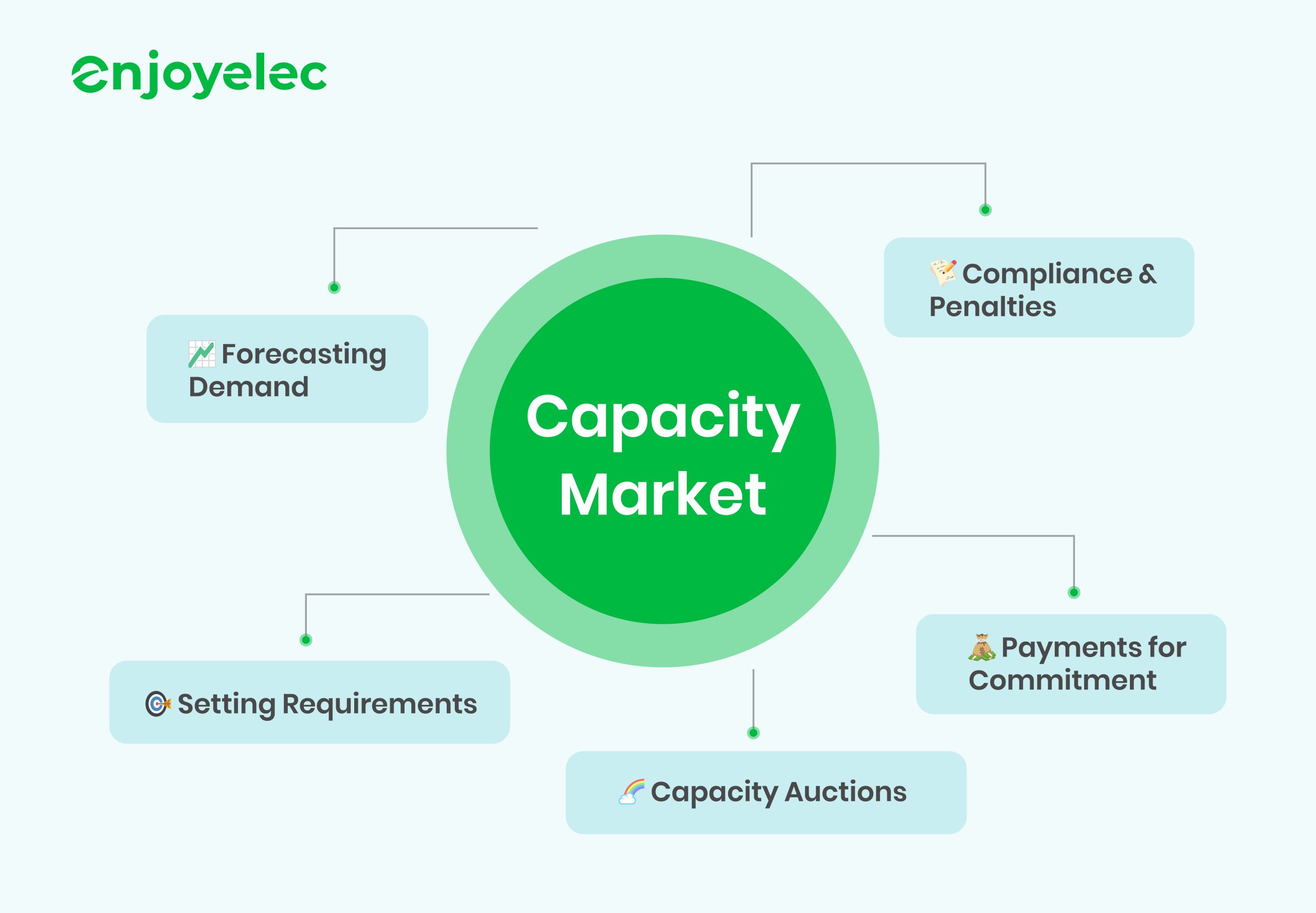

How do Capacity Markets work?

Capacity markets operate alongside other energy markets, such as wholesale electricity markets (which handle immediate power transactions) and ancillary services markets (focused on grid support and stability). Here’s a clearer breakdown of how capacity markets function:

- Forecasting Demand: Grid operators or regulators assess future electricity demand, often projecting several years ahead to understand the capacity needed for upcoming periods.

- Setting Requirements: Based on these forecasts, the necessary generation capacity is established, often through a process like a capacity auction, where the required capacity for future use is defined.

- Capacity Auctions: Power generators and other service providers (including demand response aggregators) participate in capacity auctions, offering their available resources for future use. Bids are ranked by cost, and the lowest-cost providers are selected until the total required capacity is secured.

- Payments for Commitment: Providers who win the auction are compensated for their commitment to ensure they have the capacity available, either to generate power or reduce demand, during the specified period. This compensation helps them cover the fixed operational costs of maintaining their resources.

- Compliance & Penalties: Providers are contractually obligated to meet their commitments. If they fail to make their capacity available when required, penalties are imposed to ensure reliability and prevent grid instability.

In the UK, the government holds an annual Capacity Market Auction. Let’s say there’s a forecasted spike in demand during the winter. Power providers like a gas plant, a solar farm, or even a battery storage system might bid in the auction to guarantee they’ll have enough electricity for the winter months. If they win the bid, they get paid to be on standby, ready to provide power if the grid needs it.

In this way, capacity markets ensure we always have enough electricity to keep our lights on, even when the weather is unpredictable or demand is higher than usual.

Why Capacity Markets Matter?

Here are the key reasons why capacity markets matter:

- Grid Reliability: Capacity markets help grid operators secure enough power generation capacity to meet forecasted demand, including unexpected peaks or periods of low generation. This is particularly important as the share of renewable energy (which can be intermittent) increases in the energy mix.

- Ensuring Resource Availability: These markets provide financial incentives for power plants, including traditional and flexible resources, to remain available during critical times. This ensures that backup power sources, like gas plants or demand response programs, are ready to step in when needed.

- Investment Signals: Capacity markets help signal to investors that there is a future need for new power plants or upgrades to existing ones. By guaranteeing payments for capacity, they reduce the financial risk associated with investing in generation resources, especially in markets with low energy prices.

- Cost-Effectiveness: By using competitive auctions and price mechanisms, capacity markets help determine the most cost-effective resources to meet future demand. This allows grid operators to procure the necessary capacity at the lowest possible cost, benefiting consumers.

Types of Capacity Markets

There are two types of capacity market:

- Centralized Capacity Markets

In centralized capacity markets, a central entity, such as the grid operator, manages an auction system where power producers bid to make their capacity available for future use. Providers are compensated for ensuring their capacity is ready when needed, helping maintain grid reliability. The lowest-cost options are typically selected, ensuring that energy capacity is provided efficiently and at a reasonable cost. These markets are more structured and regulated, offering a clear process for meeting future capacity needs.

- Decentralized Capacity Markets

Decentralized capacity markets, by contrast, allow for more flexibility, as power producers and other capacity providers can enter into bilateral contracts directly with market participants. This model provides more adaptability to meet specific needs and encourages more customized solutions. While less regulated than centralized markets, decentralized systems offer more room for negotiation and tailored agreements, making them particularly useful in regions where flexibility and market-driven approaches are prioritized.

The Future of Capacity Markets

The future of capacity markets is closely tied to the ongoing transition toward renewable energy. With incentives such as the Inflation Reduction Act driving the integration of more renewable resources like wind and solar into the grid, there is an increasing reliance on capacity markets to ensure a stable and reliable energy supply. These markets play a critical role in addressing the intermittency of renewable energy, ensuring that backup power is available when needed. As the energy mix becomes cleaner, capacity markets will evolve to prioritize flexible, low-carbon solutions, including energy storage, demand response, and distributed energy resources (DERs). This shift will help balance supply and demand while supporting grid stability and facilitating the decarbonization of the power sector. In the coming years, capacity markets will be essential in managing the complexity of a more decentralized, renewable-driven energy system.

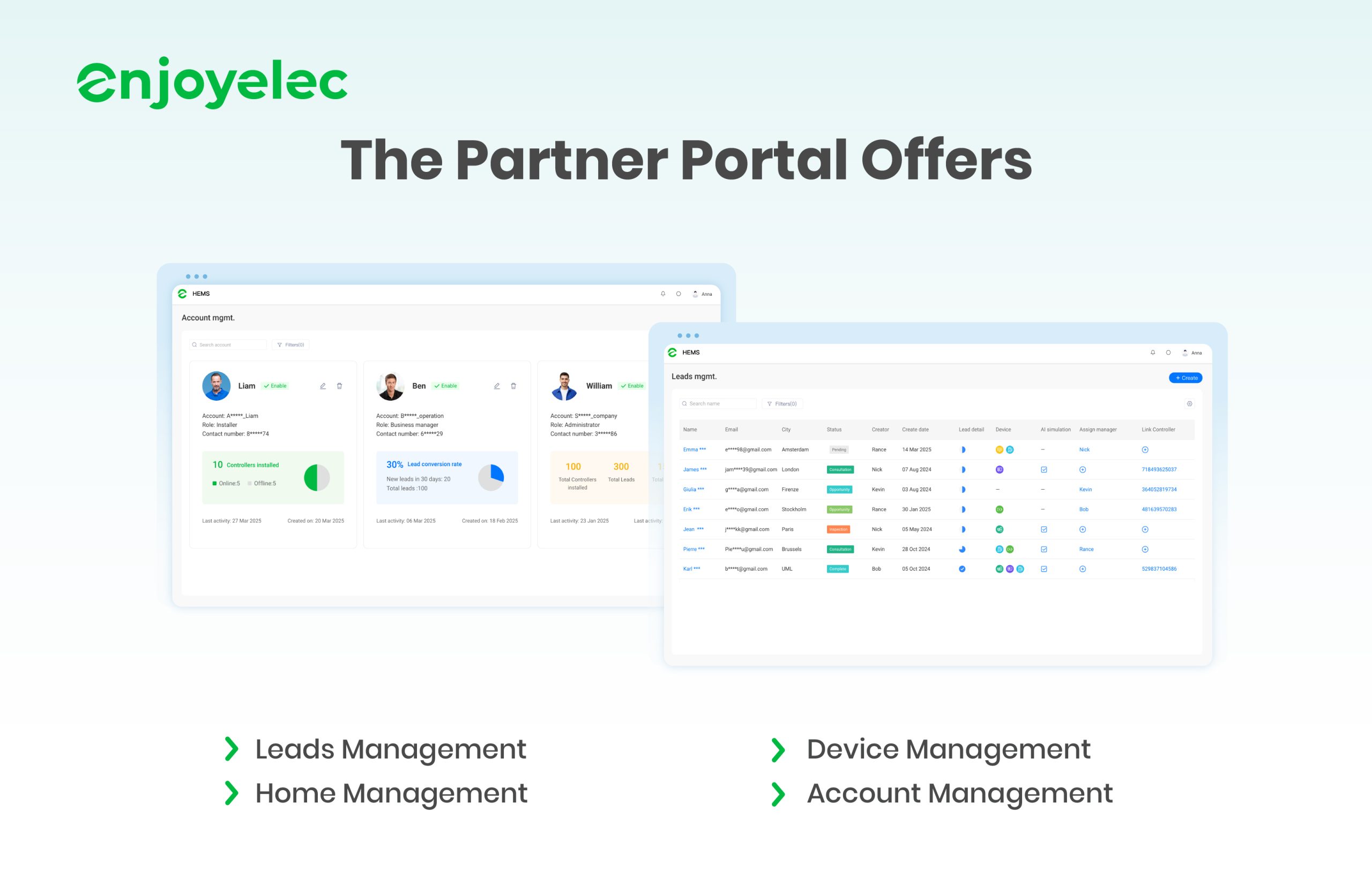

As capacity markets ensure reliable energy for the future, managing your home energy efficiently has never been more important. With our app, you can optimize your energy usage, reduce costs, and support a sustainable grid. Ready to take control of your energy? Download our app today!

Connect with us at http://www.linkedin.com/company/enjoyelec for the latest updates, insights, and news. We look forward to engaging with you and sharing our journey towards a smarter energy future.