What You Need to Know About Negative Electricity Prices

What is Negative Electricity Prices?

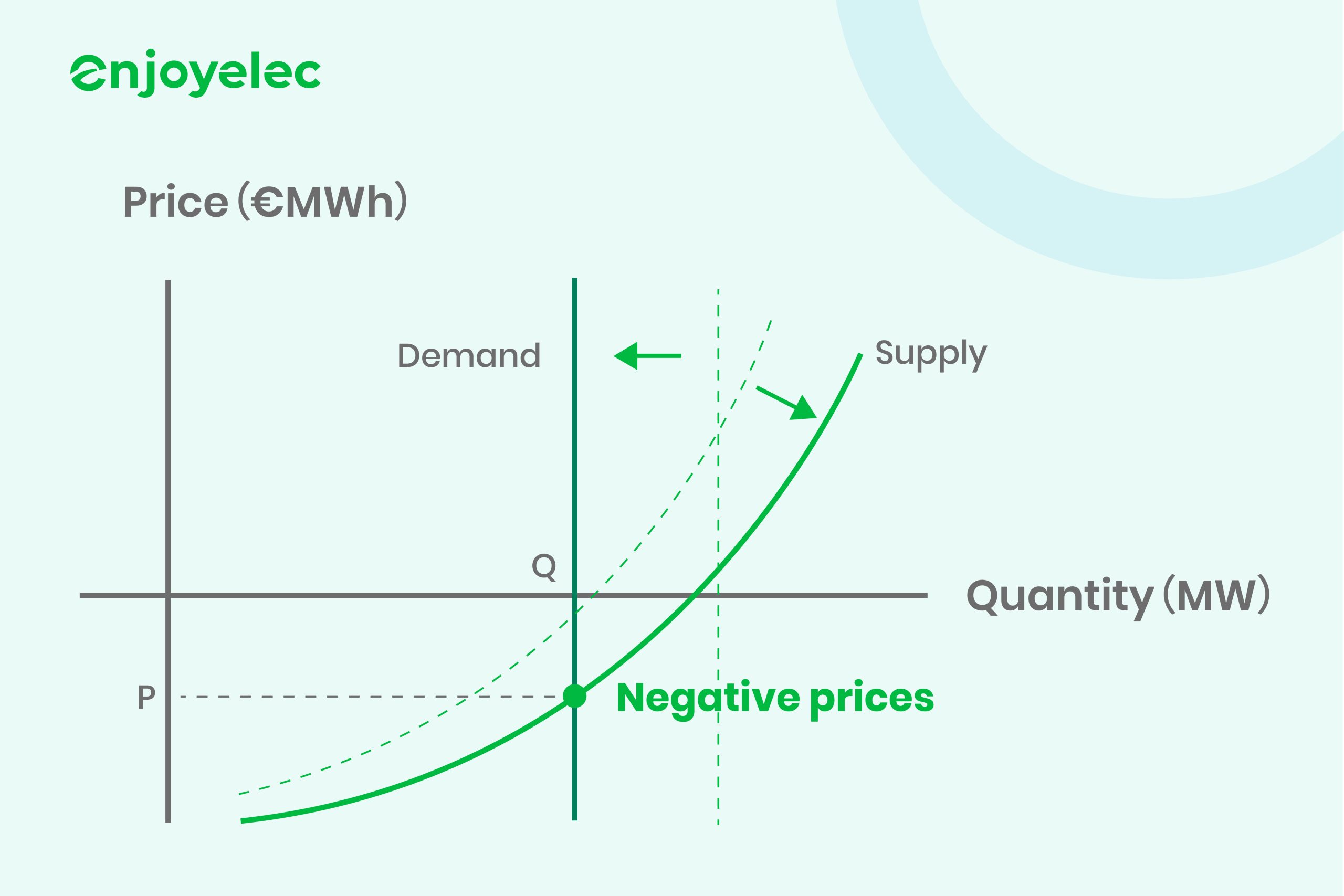

Negative prices occur when there is an oversupply of electricity coupled with reduced demand. This situation can happen in energy markets where renewable energy sources, like wind or solar power, generate a large amount of electricity during periods of low demand, such as at night or during mild weather. When there’s more electricity being produced than consumed, prices can drop below zero, creating a scenario where utilities or grid operators essentially incentivize energy consumption to balance the supply and demand on the grid.

Where do power prices come from?

Power prices start in the wholesale electricity market, where daily trades set prices for the next 24 hours. In this market, energy producers, including wind and solar farms as well as traditional sources like nuclear plants, offer electricity at specific prices. On the other side, buyers like energy retailers and large industries state how much they’re willing to pay.

This process works like an auction. Prices are set based on the balance between supply and demand, with results typically announced by early afternoon. Producers whose prices are at or below the market price sell their electricity, while buyers who bid at or above the market price get their energy.

The “merit order” system ranks energy sources by cost, prioritizing cheaper, greener options like wind and solar over more expensive sources like gas and coal. This system ensures that the most cost-effective and environmentally friendly energy is used first, keeping prices lower and supporting cleaner energy.

How do negative electricity prices occur?

Wholesale electricity prices are shaped by the balance between supply and demand. Energy producers submit offers to provide specific quantities of electricity at certain prices. The Australian Energy Market Operator (AEMO) organizes these offers for each five-minute interval, ranking them from the lowest to highest price, and then selects them in order to meet the required demand, beginning with the least expensive option.

Negative prices emerge when the amount of electricity offered at negative prices exceeds demand. This typically happens around midday when various generators, including rooftop solar, large-scale solar, wind, and coal-fired plants, are all competing to dispatch their energy.

Negative pricing acts as a signal to either boost demand or cut back supply. Renewable sources like solar and wind, along with peaking generators, can adjust their output quickly to avoid operating during these periods. However, coal-fired plants face high costs for shutting down and restarting, which can take several hours. As a result, they often continue running through negative price periods because it’s cheaper than the alternative, ensuring they’re ready to meet peak demand in the late afternoon and evening when solar power is no longer available.

It’s important to note that negative prices occur in the wholesale market and are not reflected in the retail electricity market.

Are negative prices good or bad?

Are negative prices good or bad? Negative prices in the electricity market aren’t inherently Negative prices in the electricity market aren’t inherently bad; rather, they highlight a deeper challenge— the inflexibility in how electricity is produced and consumed. Instead of viewing negative prices as a problem, they can be seen as an opportunity for innovation. They push utilities to make their power plants more adaptable to fluctuations in the market and open up new business opportunities for companies willing to respond to demand shifts. When there’s an oversupply of electricity, producers should be incentivized to reduce output, while large consumers could increase their usage when prices dip.

Renewable energy often gets blamed for driving prices below zero, but the real issue lies with the inflexibility of conventional power plants, which struggle to adjust their output in response to market conditions.

Some critics of renewable energy have suggested capping prices or banning negative bids altogether, but this approach misunderstands how the market functions. For the sake of grid stability and economic efficiency, it’s crucial to allow prices to reflect actual supply and demand, even if that means they occasionally dip into negative territory. These price signals are essential for balancing the grid, ensuring that electricity production matches demand, and encouraging investment in more flexible generation methods, demand-responsive technologies, and storage solutions that can capitalize on price fluctuations.

In essence, negative prices are not the problem—they are part of the solution, driving the market toward greater efficiency and adaptability.

Why negative energy prices are becoming more common in Europe?

Europe is increasingly seeing negative energy prices, a clear indicator of a significant imbalance between electricity supply and demand, often triggered when both solar and wind generation are particularly strong. This trend is a direct result of Europe’s heavy investments in green infrastructure, including a record number of solar panel installations last year, aimed at reducing reliance on Russian natural gas.

While Germany has garnered significant attention for its frequent negative electricity prices, this trend is far from being isolated. Multiple countries and their respective electricity exchanges have embraced negative pricing mechanisms, demonstrating a global trend. In Europe, Austria, Belgium, the Netherlands, Great Britain, France, and Switzerland have joined Germany and others in experiencing negative prices on EPEX Spot’s day-ahead and intraday markets. This integrated market structure allows for seamless price movements across borders, reflecting the interconnectedness of energy systems.

SEB Research reported in May that Germany has added more solar capacity than its consumers currently demand. In 2023, the country’s solar capacity reached 81.7 gigawatts, surpassing a maximum demand load of just 52.2 gigawatts. This summer, prices also dipped into negative territory in France, forcing nuclear plants to temporarily shut down in June—a situation that has also been observed in Spain and Scandinavia.

One of the major issues contributing to these inefficiencies is the lack of sufficient battery technology to store excess electricity. As a result, consumers often don’t benefit from lower day-ahead prices, since they typically use more energy during non-solar hours. SEB’s research warns that prolonged suppressed pricing could eventually discourage further investment in solar infrastructure. Instead, the report suggests that solar energy would benefit more if additional funding were directed toward improving battery storage and grid capacity.

Despite these challenges, Europe’s commitment to solar generation remains strong. According to Reuters, Eastern European countries are now leading solar expansion efforts. In the first seven months of this year, utility-operated solar output increased by 55% year-over-year in countries like Austria, Bulgaria, Hungary, Romania, and Poland.

How to manage the occurrence of negative power prices?

To prevent or mitigate negative power prices, several strategies can be employed:

1. Enhance Grid Flexibility

-

Demand Response Programs: Encourage consumers, particularly industrial users, to increase their electricity consumption during periods of low demand or high renewable energy generation. This can be achieved through incentives or real-time pricing models. For instance, when electricity prices turn negative, consumers should be incentivized to consume more energy, suppliers should reduce output, and storage owners should buy electricity at low prices to sell it later at higher prices.

-

Energy Storage Systems: Invest in large-scale batteries and other energy storage technologies (like pumped hydro or hydrogen storage) to absorb excess electricity during periods of low demand and release it when demand is higher. These technologies can play a crucial role in stabilizing the grid.

-

Grid Interconnections: Improve interconnections between national grids to allow the export of surplus electricity to neighboring countries where demand might be higher. Enhanced grid connections can offer extra relief during periods of excess supply.

2. Improve Forecasting and Market Design

-

Better Renewable Energy Forecasting: Enhance the accuracy of forecasting models for renewable energy production. This improvement helps in better balancing supply and demand, scheduling generation in a way that minimizes price volatility, and reducing the likelihood of negative prices.

-

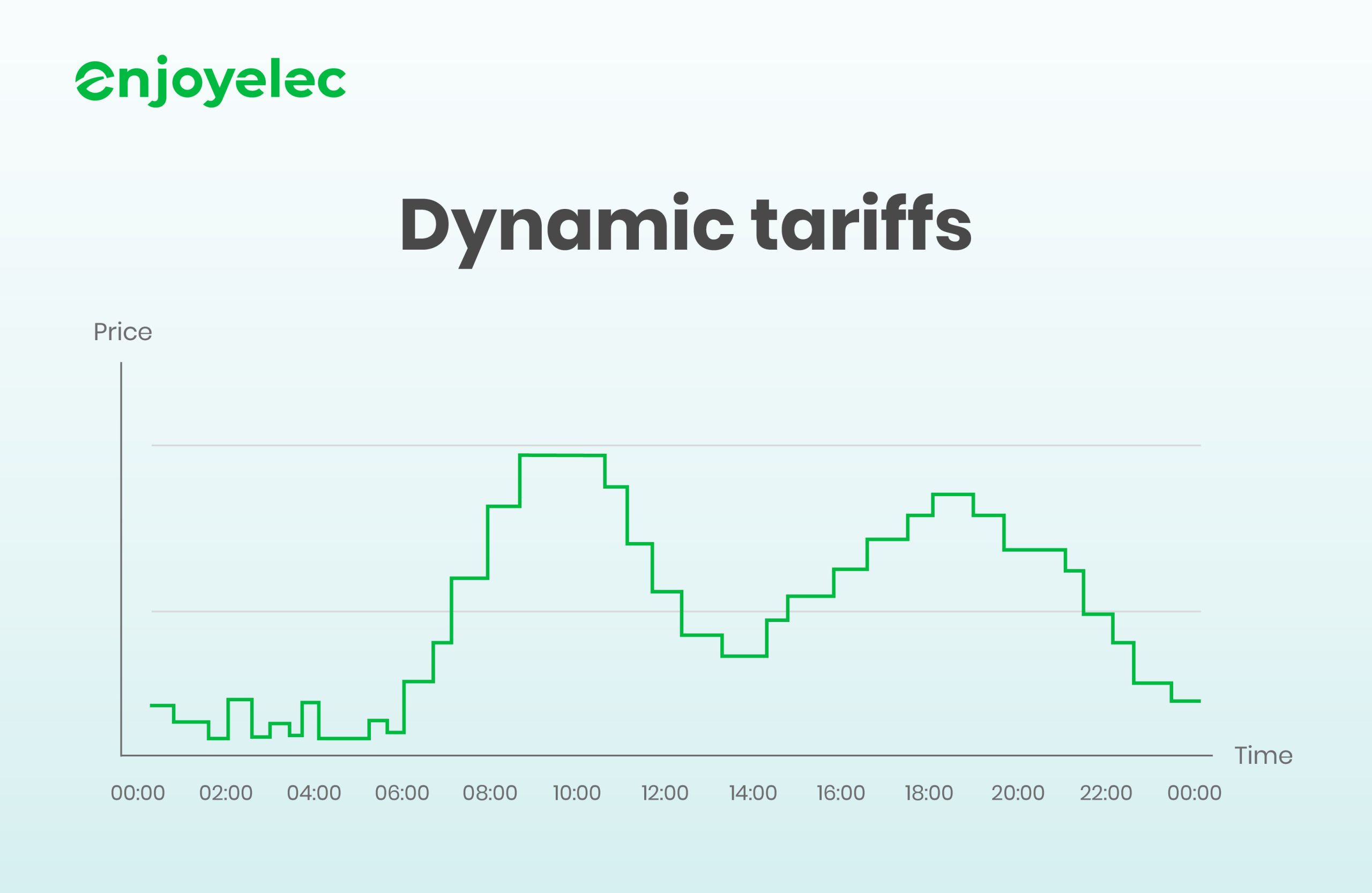

Dynamic tariff Mechanisms: Introduce more sophisticated pricing mechanisms that reflect real-time supply and demand, potentially including negative prices during periods of excess supply. Better forecasting and pricing models can prevent extreme occurrences of negative pricing.

3. Adjusting Renewable Energy Policies

-

Capacity Payments: Shift towards capacity markets where power producers are paid not just for the electricity they produce, but also for having capacity available to meet peak demand. This approach helps balance financial incentives and reduces the likelihood of oversupply.

4. Regulatory and Policy Adjustments

-

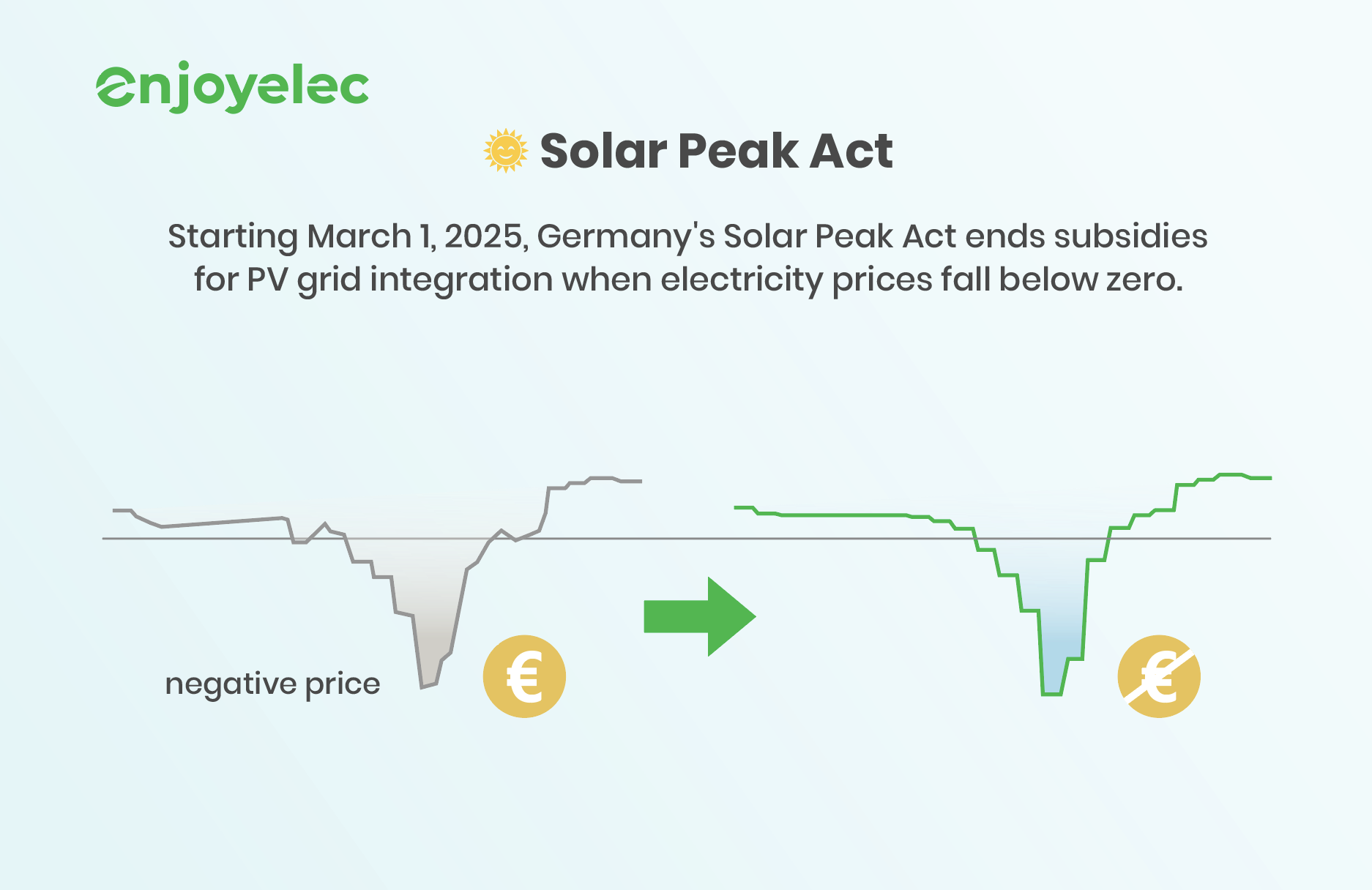

Review Subsidies and Support Schemes: Adapt renewable energy support mechanisms to be more responsive to market conditions. For example, ending incentives or feed-in tariffs could remove part of the motivation for renewables to bid negatively in some markets. Additionally, reducing subsidies during periods of low demand or excess supply can help align market fundamentals more closely with actual supply and demand conditions.

-

Long-term Contracts: Encourage long-term power purchase agreements (PPAs) for renewable energy to provide stability and reduce the impact of short-term market fluctuations.

5. Promote Sector Coupling and Policy Adjustments

-

Electrification of Other Sectors: Encourage the use of electricity in other sectors, such as heating, transportation (e.g., electric vehicles), and industry, particularly during times when there is excess renewable generation.

-

Supply-Side Flexibility: Allow conventional power plants to adjust their output based on market conditions. This includes using renewable sources like biogas and hydro-power, which can provide a more consistent energy supply and regulation.

Implementing these strategies requires coordinated efforts among grid operators, energy producers, policymakers, and consumers. By enhancing grid flexibility, improving market design, adjusting renewable energy policies, and making necessary regulatory changes, Europe can reduce the frequency of negative power prices while continuing to integrate renewable energy sources into the grid.

Download our HEMS app now to gain insights into how these dynamics influence electricity pricing and how you can make informed decisions in a changing energy landscape.

Connect with us at http://www.linkedin.com/company/enjoyelec for the latest updates, insights, and news. We look forward to engaging with you and sharing our journey towards a smarter energy future.